By NYLAG Financial Counselors Alma Rojas and Ruth Cedeno

Everyone has a right to economic financial safety and justice. Various factors, including a lack of awareness, community resources, and support services, can cause elder financial abuse, scams, and exploitation to perpetuate. Unfortunately, feelings of shame and embarrassment, fear of retaliation, and not wanting to get one’s abuser in trouble can make it hard for individuals to report financial exploitation, resulting in underreporting. In fact, according to the U.S. Department of Justice, only 1 in 44 cases of financial elder abuse are reported.

In our everyday work, NYLAG’s Financial Empowerment and Advocacy Unit sees the costs of financial abuse on individuals and our communities. As the National Council on Aging states, “The first step to protecting oneself and those we love from scams is simply knowing these dishonest practices exist.”

Read our tips on how to spot, prevent, and report financial abuse of older individuals, as well as general tips on how to protective oneself from fraud, scams, and deceptive practices.

Let’s take a closer look at government imposters and email phishing scams. These types of scams can happen to anyone, regardless of age, but older individuals are more likely to experience them, often in the form of a Medicare scams.

Scenario:

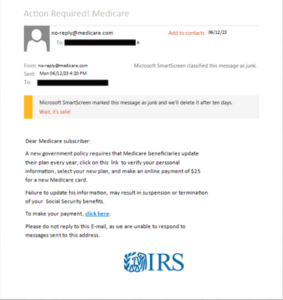

Alejandro worked for over 40 years in the restaurant business. He currently receives Social Security Benefits and Medicare. He received the email pictured below on June 12, from an agent claiming to be from Medicare. The message stated that “a new government policy requires that Medicare beneficiaries update their plan every year, click on this link to verify your personal information, select your new plan, and make an online payment of $25 for a new Medicare card.” The message also stated that if Alejandro failed to update his information, he would risk losing Social Security benefits.

How do we know this is a government imposter scam?

- It was sent over email. While many government agencies offer email subscriptions to keep individuals informed on general policies and benefits, they will not initiate contact with an individual regarding a personal issue via email, texts, or social media. Instead, they will likely send notices via standard mail.

- The e-mail address looks suspicious. Unscrupulous actors may mimic the email of government agencies. However, if you look closely, you can see that the email is often a fake (for example, they might use a “.com” instead of a “.gov” email address).

- The logo is incorrect. The message may have the Medicare logo on the body of the message; however, with a closer look, it may be fuzzy or distorted. In some cases, the message may also include logos from a completely different government agency. (In Alejandro’s case, the email included an IRS logo.)

- It contains typos and misspellings. Scam messages also often include spelling or grammatical errors or nonsensical phrases that may be hard to spot during a quick glance.

- The information is incorrect. Medicare does not require beneficiaries to change plans if they are satisfied with their current plan.

- It gives a time limit. Unscrupulous actors often use time limits to create pressure for individuals to act quickly without doing research.

What are the risks?

- If Alejandro clicks on the link, his computer can become vulnerable to malware and viruses. This is called a phishing scam, which is one of the most common attacks on individuals.

- If Alejandro clicks on the link and enters his personal information and bank account information, his information could be used to access important accounts, and could result in the opening of fraudulent financial accounts in the future. In addition, he could lose significant funds from his bank account.

- If Alejandro clicks on the link and enters his Medicare information, it can cost the U.S. government thousands of dollars in losses if his information is used to charge Medicare for fraudulent services.

How to avoid phishing scams:

- Do not open emails from unknown senders (if Medicare does not have your email, they would not message you).

- Delete suspicious messages and do not click on any links.

- Keep up to date with information about government resources and common frauds/scams.

What to do if you or someone you know has received this type of scam message:

- Report the imposter to the FTC because it is highly likely the imposters have tried to reach out to other individuals as well.

- If you open the message and read it, take a breather after reading. Don’t feel pressured to make a quick decision; taking time to pause can help you verify whether the message is legitimate or not.

- If you do click on a suspicious link, run a virus/safety scan on your computer. Change any sensitive passwords and monitor your accounts for any suspicious activity. Consider putting a fraud-alert or freezing access to your credit report.

- If funds are missing from your bank account, contact the bank immediately to alert them and prevent future access to your funds. You might be able to recuperate lost funds.

- If your personal information has been compromised, file an Identity Theft Affidavit and follow the recommended recovery steps.

- If your Medicare information was compromised, you can also report fraud to Medicare directly.

Raising awareness is a great first step to preventing fraud, and many government agencies, including Medicare, routinely share great resources and tips to raise awareness of scams that are likely to target older people. However, one reason these types of scams are so prevalent is that the U.S. health care system can be extremely hard to navigate, and the risk of losing insurance can create significant financial stress, which can make folks more susceptible to scams because they feel pressured to act quickly. As individuals and communities, we can advocate for a less complex system to benefit our more vulnerable members and all of us as well.

Disclaimer– while this article focuses on a Medicare scam that is tied to a financial scam, please note that financial counselors are not health care or benefit counselors. We cannot help with health insurance or medical questions; please contact the appropriate agency for assistance.

Still have questions?

A NYLAG financial counselor can help you understand and prevent financial abuse and exploitation at any age. Connect with a NYLAG financial counselor.